This article is part of a Future of Life series on the AI safety research grants, which were funded by generous donations from Elon Musk and the Open Philanthropy Project.

The Financial World of AI

Contents

Click here to see this page in other languages: Russian ![]()

Automated algorithms currently manage over half of trading volume in US equities, and as AI improves, it will continue to assume control over important financial decisions. But these systems aren’t foolproof. A small glitch could send shares plunging, potentially costing investors billions of dollars.

For firms, the decision to accept this risk is simple. The algorithms in automated systems are faster and more accurate than any human, and deploying the most advanced AI technology can keep firms in business.

But for the rest of society, the consequences aren’t clear. Artificial intelligence gives firms a competitive edge, but will these rapidly advancing systems remain safe and robust? What happens when they make mistakes?

Automated Errors

Michael Wellman, a professor of computer science at the University of Michigan, studies AI’s threats to the financial system. He explains, “The financial system is one of the leading edges of where AI is automating things, and it’s also an especially vulnerable sector. It can be easily disrupted, and bad things can happen.”

Consider the story of Knight Capital. On August 1, 2012, Knight decided to try out new software to stay competitive in a new trading pool. The software passed its safety tests, but when Knight deployed it, the algorithm activated its testing software instead of the live trading program. The testing software sent millions of bad orders in the following minutes as Knight frantically tried to stop it. But the damage was done.

In just 45 minutes, Knight Capital lost $440 million – nearly four times their profit in 2011 – all because of one line of code.

In this case, the damage was constrained to Knight, but what happens when one line of code can impact the entire financial system?

Understanding Autonomous Trading Agents

Wellman argues that autonomous trading agents are difficult to control because they process and respond to information at unprecedented speeds, they can be easily replicated on a large scale, they act independently, and they adapt to their environment.

With increasingly general capabilities, systems may learn to make money in dangerous ways that their programmers never intended. As Lawrence Pingree, an analyst at Gartner, said after the Knight meltdown, “Computers do what they’re told. If they’re told to do the wrong thing, they’re going to do it and they’re going to do it really, really well.”

In order to prevent AI systems from undermining market transparency and stability, government agencies and academics must learn how these agents work.

Market Manipulation

Even benign uses of AI can hinder market transparency, but Wellman worries that AI systems will learn to manipulate markets.

Autonomous trading agents are especially effective at exploiting arbitrage opportunities – where they simultaneously purchase and sell an asset to profit from pricing differences. If, for example, a stock trades at $30 in one market and $32 in a second market, an agent can buy the $30 stock and immediately sell it for $32 in the second market, making a $2 profit.

Market inefficiency naturally creates arbitrage opportunities. However, an AI may learn – on its own – to create pricing discrepancies by taking misleading actions that move the market to generate profit.

One manipulative technique is ‘spoofing’ – the act of bidding for a stock item with the intent to cancel the bid before execution. This moves the market in a certain direction, and the spoofer profits from the false signal.

Wellman and his team recently reproduced spoofing in their laboratory models, as part of an effort to understand the situations where spoofing can be effective. He explains, “We’re doing this in the laboratory to see if we can characterize the signature of AIs doing this, so that we reliably detect it and design markets to reduce vulnerability.”

As agents improve, they may learn to exploit arbitrage more maliciously by creating artificial items on the market to mislead traders, or by hacking accounts to report false events that move markets. Wellman’s work aims to produce methods to help control such manipulative behavior.

Secrecy in the Financial World

But the secretive nature of finance prevents academics from fully understanding the role of AI.

Wellman explains, “We know they use AI and machine learning to a significant extent, and they are constantly trying to improve their algorithms. We don’t know to what extent things like market manipulation and spoofing are automated right now, but we know that they could be automated and that could lead to something of an arms race between market manipulators and the systems trying to detect and run surveillance for market bad behavior.”

Government agencies – such as the Securities and Exchange Commission – watch financial markets, but “they’re really outgunned as far as the technology goes,” Wellman notes. “They don’t have the expertise or the infrastructure to keep up with how fast things are changing in the industry.”

But academics can help. According to Wellman, “even without doing the trading for money ourselves, we can reverse engineer what must be going on in the financial world and figure out what can happen.”

Preparing for Advanced AI

Although Wellman studies current and near-term AI, he’s concerned about the threat of advanced, general AI.

“One thing we can do to try to understand the far-out AI is to get experience with dealing with the near-term AI,” he explains. “That’s why we want to look at regulation of autonomous agents that are very near on the horizon or current. The hope is that we’ll learn some lessons that we can then later apply when the superintelligence comes along.”

AI systems are improving rapidly, and there is intense competition between financial firms to use them. Understanding and tracking AI’s role in finance will help financial markets remain stable and transparent.

“We may not be able to manage this threat with 100% reliability,” Wellman admits, “but I’m hopeful that we can redesign markets to make them safer for the AIs and eliminate some forms of the arms race, and that we’ll be able to get a good handle on preventing some of the most egregious behaviors.”

About the Future of Life Institute

The Future of Life Institute (FLI) is a global think tank with a team of 20+ full-time staff operating across the US and Europe. FLI has been working to steer the development of transformative technologies towards benefitting life and away from extreme large-scale risks since its founding in 2014. Find out more about our mission or explore our work.

Related content

Other posts about AI, Grants Program, Recent News

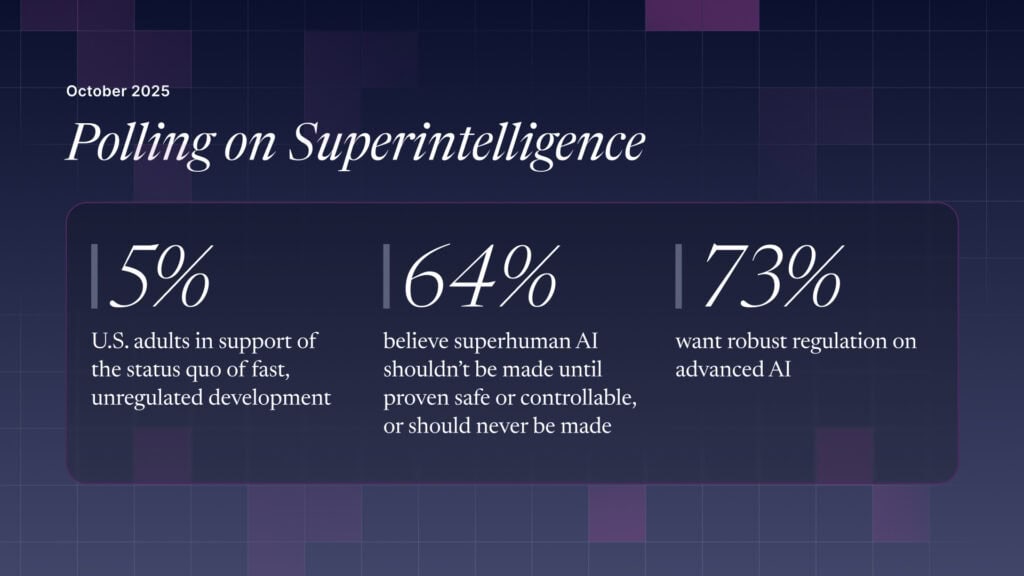

The U.S. Public Wants Regulation (or Prohibition) of Expert‑Level and Superhuman AI